Modi’s Tax Overhaul: A Big Relief for Consumers—But a Strain on Government Revenue

Description:

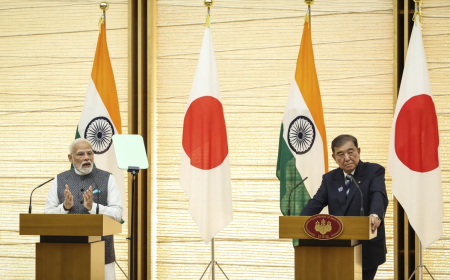

Prime Minister Narendra Modi has rolled out India's most substantial GST reform since 2017. The sweeping changes include slashing rates on daily essentials and consumer electronics, eliminating the 28% GST slab, and simplifying the tax structure. While expected to suppress government revenue by approximately $20 billion annually, analysts predict a 0.6% boost to GDP in the year ahead. This economic move also comes amid rising U.S. trade tensions and is seen as a political play ahead of Bihar state elections.

India's tax landscape is undergoing a tectonic shift. In a surprise move, Prime Minister Modi has overhauled the Goods and Services Tax (GST), targeting both consumer relief and economic stimulus. The 28% slab has been abolished entirely, and several items previously in the 12% bracket—particularly daily essentials and electronics—have been reduced to just 5%. The simplification of the tax regime is expected to be a boon for consumers and businesses alike, potentially sparking a surge in domestic consumption and overall economic activity.

However, the reforms don't come cheap. Estimates suggest a revenue hit of around $20 billion annually, placing immediate pressure on government finances. Still, economists argue this may well be a calculated trade-off: a projected 0.6 percentage point increase in GDP over the next year could help offset revenue losses in the longer run.

Context matters. This tax shake-up arrives amid escalating trade tensions with the U.S. and comes just before important state elections in Bihar—allowing the government to cast itself as a champion of both the common man and national economic resilience. As election season approaches, Modi’s team may well leverage this tax reform to underscore his administration’s commitment to affordability and growth