Insider Trading Suspicions Arise as Nazara Technologies Stock Crashes Post-Gaming Bill

A debate over a potential ₹590 crore profit from a timely stock sale in Nazara Technologies, raising insider trading concerns as the company’s stock plummeted 20% after the Gaming Bill’s passage on August 21, 2025.

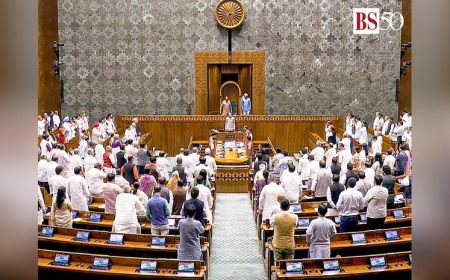

Public opinion is increasingly abuzz with concerns about possible insider trading in the Indian stock market following a significant financial move involving Nazara Technologies. Reports suggest that an unidentified stakeholder purchased a ₹180 crore stake in the company before 2021, selling it for ₹770 crore in June 2025, yielding a ₹590 crore profit. This transaction took place just weeks before the Lok Sabha passed the Online Gaming Regulation Bill on August 21, 2025, which triggered a dramatic 20% crash in Nazara’s stock price last week, with the stock currently trading at ₹1,157.00 according to market data.

The incident has sparked widespread debate, with many questioning who lost money, especially given that 68% of the company is owned by the public. This has fueled speculation of corruption among investors and analysts, who point to the timing of the sale ahead of the policy change. The new bill imposed a 28% GST on online gaming, severely impacting firms like Nazara, which holds a 47.7% stake in PokerBaazi, a platform affected by the legislation.

Supporting these concerns, a 2019 study by the National Bureau of Economic Research indicated that insider trading profits can exceed 25% in regulated markets, lending weight to the suspicion surrounding the transaction’s timing. India’s Securities and Exchange Board of India (SEBI) reported in 2023 that retail investors, holding 55% of the equity market, are particularly vulnerable to such policy-driven market shifts. Public reactions have varied, with some alleging a “systematic fraud on the small investor,” while others argue it reflects typical market behavior or dismiss it as old news.

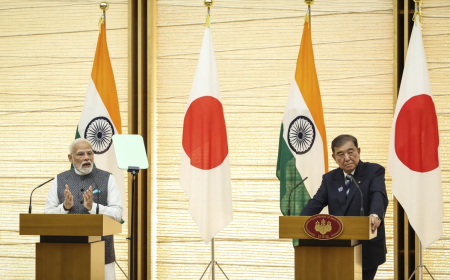

Speculation has also arisen about possible links to influential figures, with some drawing parallels to the 2020 pre-budget meetings where Prime Minister Narendra Modi engaged with business leaders. However, no concrete evidence connects any individuals to the Nazara transaction, urging caution against unverified corruption claims. Opinions range from accusations of insider trading being a common practice to assertions that “everyone made money,” highlighting the polarized views among the public.