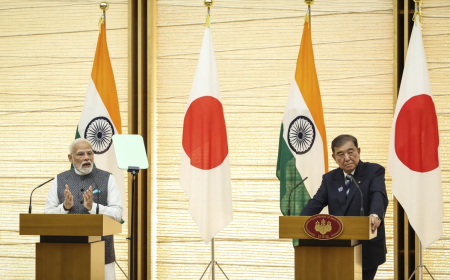

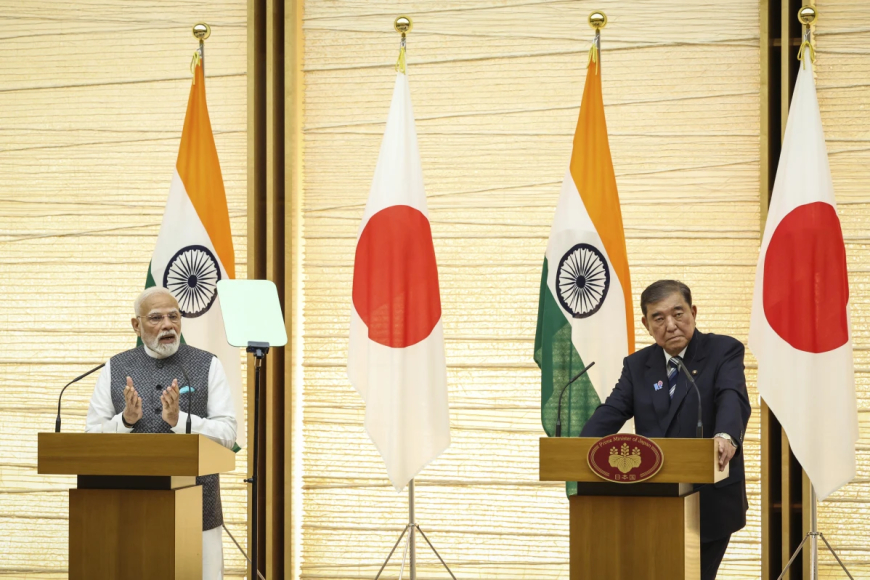

India–Japan Anchor Strategic Ties, $68B Investment Pact

India’s plan to ease GST on widely used goods is facing resistance from several states that warn of crippling revenue losses and want alternate compensatory levies.

Prime Minister Narendra Modi’s proposal to lower the Goods and Services Tax (GST) on essential consumer items—from standard rates to 5% or 18%, and 40% for luxury goods—faces mounting opposition. This fiscal reform, intended to buoy consumption before Diwali and counter U.S. tariffs, has alarmed opposition-led states. Regions such as Tamil Nadu, Kerala, and West Bengal warn that the shift could slash annual state revenues by ₹1.5 to 2 trillion ($16.7–22.7 billion), as they bear over 70% of the burden .

These states are pushing for a new “sin and luxury” tax to fill the gap left by the expiring compensation cess, which was originally introduced during the pandemic. The GST Council—comprising both central and state finance ministers—is set to convene soon, with outcomes poised to reshape India’s fiscal architecture .